Price Trend Forecasting in the Brazilian Stock Market using Discrete-Time Markov Chain

DOI:

https://doi.org/10.14295/vetor.v34i1.16774Keywords:

Discrete-Time Markov Chain, Time-Series Prediction, Stock Market PredictionAbstract

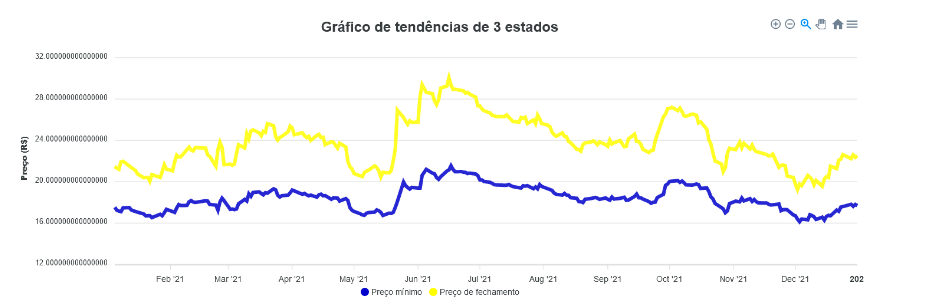

Understanding the stock market trend in order to predict price movement is very important for investment decisions given that stock prices are affected not only by the financial state of the company, but also by political, social, economic, global and local, plus many other factors. Markov Chains provide a powerful tool for performing mathematical and computational modeling and also have been used to predict trends in the stock market. From this, the following work brings a computational tool modeled based on the knowledge obtained through studies on discrete-time Markov Chains capable of making predictions of price trends of stocks on the Brazilian stock exchange using the 3-state method. Analyzes were carried out on 50 BOVESPA stocks in order to observe whether the forecast success percentage has any relation to the length of the period for building the transition matrix. These tests were carried out for the years 2019, 2020 and 2021 in order to observe whether there were impacts on the effectiveness of the methods during the period of the COVID-19 pandemic.

Downloads

References

D. Zhang e X. Zhang, “Study on forecasting the stock market trend based on stochastic analysis method,” International Journal of Business Management,” vol. 4, no. 6, pp. 163–160, 2009. Disponivel em: https://doi.org/10.5539/ijbm.v4n6p163

S. Vasanthi, M. Subha, e S. T. Nambi, “An empirical study on stock index trend prediction using Markov chain analysis,” Journal of Banking Financial Services and Insurance Research, vol. 1, no. 1, pp. 72–87, 2011. Disponível em: https://www.indianjournals.com/ijor.aspx?target=ijor:jbfsir&volume=1&issue=1&article=005

Q. Sultan, K. Fatima, and J. Ahmed, “Application of Markov Chain to Model and Predict Share Price Movements: A Study of HBL Share Price Movements in Pakistan’s Stock Market,” Bi-Annual Research Journal “BALOCHISTAN REVIEW”, vol. XL, no. 1, 2010, pp. 100–113. Disponível em: https://www.researchgate.net/publication/343650646_Application_of_Markov_Chain_to_Model_and_Predict_Share_Price_Movements_A_Study_of_HBL_Share_Price_Movements_in_Pakistan's_Stock_Market

A. Bairagi e S. Kakaty, “Analysis of stock market price behaviour: a markov chain approach,” International Journal of Recent Scientific Research, vol. 6, no. 10, pp. 7061–7066, 2015. Disponível em: https://www.recentscientific.com/sites/default/files/3581.pdf

S. Otieno, E. O. Otumba, e R. N. Nyabwanga, “Application of Markov Chain to Model and Forecast Stock Market Trend: a Study of Safaricom Shares in Nairobi Securities Exchange, Kenya,” International Journal of Current Research, vol. 7, no. 4, pp. 14712–14721, 2015. Disponível em: https://www.journalcra.com/sites/default/files/issue-pdf/8260.pdf

D. N. Choji, S. N. Eduno, e G. T. Kassem, “Markov chain model application on share price movement in stock market,” Computer Engineering and Intelligent Systems, vol. 4, no. 10, pp. 84–95, 2013. Disponível em: https://iiste.org/Journals/index.php/CEIS/article/view/7972/8139

V. G. Kulkarni, Modeling and Analysis, Design, and Control of Stochastic Systems, 1a ed., New York, USA: Springer-Verlag, 1999.

V. Atsalakis, Computation Optimization in Economics and Finance Research Compendium, 1a ed., New York, USA: Nova Science Publishers, Inc Editors, 2013.

G. Atsalakis e K. Valavanis, “Survey stock market forecasting techniques – Part II: Soft computing methods,” Expert Systems with Applications, vol. 36, no. 3(2), pp. 5932–5941, 2009. Disponível em: https://doi.org/10.1016/j.eswa.2008.07.006

O. B. Sezer, M. U. Gudelek, e A. M. Ozbayoglu, “Financial time series forecasting with deep learning: A systematic literature review: 2005–2019,” Applied Soft Computing, vol. 90, p. 106181, 2020. Disponível em: https://doi.org/10.1016/j.asoc.2020.106181

R. Sukkati e D. A. Torse, “Stock market forescasting techniques: A survey,” International Research Journal of Engineering and Technology (IRJET), vol. 6, no. 5, pp. 4842-4844, 2019. Disponível em: https://www.irjet.net/archives/V6/i5/IRJET-V6I5577.pdf

R. Sasikumar e A. S. Abdullah, “Applications of various stochastic models in financial prediction,” International Journal of Scientific and Innovative Mathematical Research (IJSIMR), vol. 3, no. 3, pp. 852–857, 2015. Disponível em https://www.researchgate.net/publication/295907256_APPLICATIONS_OF_VARIOUS_STOCHASTIC_MODELS_IN_FINANCIAL_PREDICTION_A_Sheik_Abdullah

N. Redzwan, N. Musa, A. H. A. Latip, Y. A. Latif, e I. N. A. Rahman, “Stock market analysis during election period in Malaysia,” International Journal of Business and Economy, vol. 1, no. 2, pp. 93-102, 2019. Disponível em: https://myjms.mohe.gov.my/index.php/ijbec/article/view/7828

L. Troiano e P. Kriplani, “Predicting trend in the next-day market by hierarchical hidden Markov model,” em 2010 International Conference on Computer Information Systems and Industrial Management Applications (CISIM), Krakow, Poland: IEEE, 2010, pp. 199-204. Disponível em: https://doi.org/10.1109/CISIM.2010.5643663

Y. Sun, “Index forecast study based on amended weighted Markov chain in China,” International Journal of Trade, Economics and Finance, vol. 11, no. 5, pp. 98-103, 2020. Disponível em: https://doi.org/10.18178/ijtef.2020.11.5.674

A. Fritiyanto e T. E. Lestari (2018), “Application of Markov chain to stock trend: A study of PT HM Sampoerna, tbk,” em IOP Conference Series: Materials Science and Engineering, Volume 434, 3rd Annual Applied Science and Engineering Conference (AASEC 2018), Bandung, Indonesia: IOP, 2018. Disponível em: https://doi.org/10.1088/1757-899X/434/1/012007

I. Adesokan, “Markov chain asset pricing model for an emerging market”, Dissertação de Mestrado, Mestrado em Matemática, Pan African University, Institute for Basic Sciences, Technology and Innovation, Nairobi, Quênia, 2018. Disponível em: http://ir.jkuat.ac.ke/handle/123456789/4694

M. K. Bhusal, “Application of markov chain model in the stock market trend analysis of Nepal,” International Journal of Scientific Engineering Research, vol. 8, no. 10, pp. 1733-1745, 2017. Disponível em: https://www.ijser.org/researchpaper/Application-of-Markov-Chain-Model-in-the-Stock-Market-Trend-Analysis-of-Nepal.pdf

R. P. Padhy, M. R. Patra, e S. C. Satapathy, “RDBMS to NoSQL: Reviewing some next-generation non-relational databases,” International Journal of Advanced Engineering Science and Technologies, vol. 11, no. 1, pp. 15–30, 2011. Disponível em: https://www.researchgate.net/profile/Rabi-Padhy/publication/265062016_RDBMS_to_NoSQL_Reviewing_Some_Next-Generation_Non-Relational_Database%27s/links/5476b2930cf29afed61424a6/RDBMS-to-NoSQL-Reviewing-Some-Next-Generation-Non-Relational-Databases.pdf

W. Castello Branco Neto, A. A. Salvi, e W. P. Souza, “Hybrid neural networks applied to Brazilian stock market,” Revista de Informática Teórica e Aplicada, vol. 7, no. 2, pp. 42–65, 2020. Disponível em: https://doi.org/10.22456/2175-2745.88911

R. C. Dametto, “Estudo da aplicação de redes neurais artificiais para predição de séries temporais financeiras,” Dissertação de mestrado, Programa de Pós-Graduação em Engenharia de Produção, Universidade Estadual Paulista, Bauru, Brasil, 2018. Disponível em: http://hdl.handle.net/11449/157058

F. A. Oliveira, C. N. Nobre, L. E. Zárate, “Applying Artificial Neural Networks to prediction of stock price and improvement of the directional prediction index – Case study of PETR4, Petrobras, Brazil,” Expert Systems with Applications, vol. 40, no. 8, pp. 7596–7606. Disponível em: https://doi.org/10.1016/j.eswa.2013.06.071